Hint: This website is not optimized for your browser version.

This is how the electricity market works

The electricity market is made up of various submarkets with their own price signals, which producers and consumers use to base their planning on. Transmission system operators use balancing capacity to correct unpredictable deviations from these plans. The balancing group and balancing energy system ensure that supply and demand is employed as cost effectively as possible. The electricity market thus rewards output and capacity.

Supply and demand determine the price on every market. Any farmer can offer potatoes at the weekly market, for example. If a shopper needs potatoes and is willing to pay the price asked, the two trading partners do business. The customer pays, takes the vegetables and prepares them, and can sell them on immediately or chill them to be used later. With electricity, it's different.

Unlike other goods, electricity is grid-based and very difficult to store. Although batteries can be found in every household, most technologies for the storage of electricity on a large scale are still limited. They are either not fully developed or not profitable on the market. This means that electricity must be produced at the same moment that it is consumed.

The electricity market brings supply and demand together.

The main element to control the market is the price.

One of the results of this is that the electricity price fluctuates throughout the day. When there is a large supply and low demand, the price is low. Conversely, prices rise when there is strong demand for a low supply. The relationship of supply to demand, and thus prices, can change relatively quickly on the electricity market, for example, if strong winds drive wind turbines or a major power plant experiences an outage. Those selling and buying electricity must therefore keep an eye on prices right up until the time it is supplied.

The graph below shows Wholesale prices from the past ten days:

The electricity market is made up of submarkets with different prices

There are therefore different trading products on the exchange with different periods of time between purchase and actual supply. Electricity can be traded several years in advance on the futures market and buyers use these long-term contracts to hedge against the risk of rising prices. For this planning certainty, they pay a premium, which sellers then register as additional revenue. Long-term contracts secure income for the producers, which they can use to finance new generating capacity, for example.

As the day of supply draws closer, the actual volumes of consumption and generation can be predicted more accurately, so the short-term spot market consists of two markets with different lead times: the day-ahead and intraday markets. Market players on the day-ahead market trade in electricity for the following day. Bids and offers specifying the amount and supply time must be submitted by midday. The exchange then determines the wholesale price for each hour of the next day and accepts the winning bids and offers. The wholesale price determined in this way is an important reference value for the electricity market, rather like the closing price of a stock on the stock market. For this reason, the day-ahead Wholesale prices of the most important electricity exchange EPEX are shown on the SMARD website. Electricity can be traded until 30 minutes before supply in the continuous intraday trading. The lead time for trading within a Control area is just five minutes.

Long and short-term trading over-the-counter

Electricity is traded over-the-counter (OTC) as well as on the exchange. This can take place either on organised market places or bilaterally. In OTC trading, the two trading partners agree on the price and amount between themselves. It includes long-term contracts, comparable to the futures market, and very short-term ones comparable to the spot market.

The electricity market ensures sufficient capacity and a secure supply

Sufficient capacity – ie producers or flexible consumers – must be available on the market to make sure that supply and demand can be balanced at all times. Price signals ensure that market players provide an efficient mix of technologies made up of flexible producers and flexible consumers and invest in new generating or consumption capacity in good time. The market players use price quotes on the futures market and forward-looking market price forecasts for their investment decisions. If this information suggests that investments will pay off, then a key pre-condition for a positive investment decision is in place.

The electricity market additionally always ensures via price signals that the existing capacity is contracted and actually used to the extent necessary.

Balancing energy costs synchronise generation and consumption

It is technically important that at all times just as much power is fed into the electricity grid as is taken from it. Balancing groups are the commercial solution to the balancing of generation and consumption. The balancing group system obliges all producers and consumers to report and maintain balanced schedules on the basis of demand and generation forecasts and to offset unforeseen deviations from the schedule using Balancing energy from Balancing services.

Every producer and consumer in Germany is included in a balancing group. These are virtual energy quantity accounts managed by a balance responsible party. Among other important tasks, the balance responsible party acts as "bookkeeper", keeping a record of how much electricity each participant feeds into or takes from the grid (ie produces or consumes) at all times. As in financial accounting, the balance responsible party ensures that additions and disposals are correct – with the difference that in an energy quantity account, there must be no sum left over.

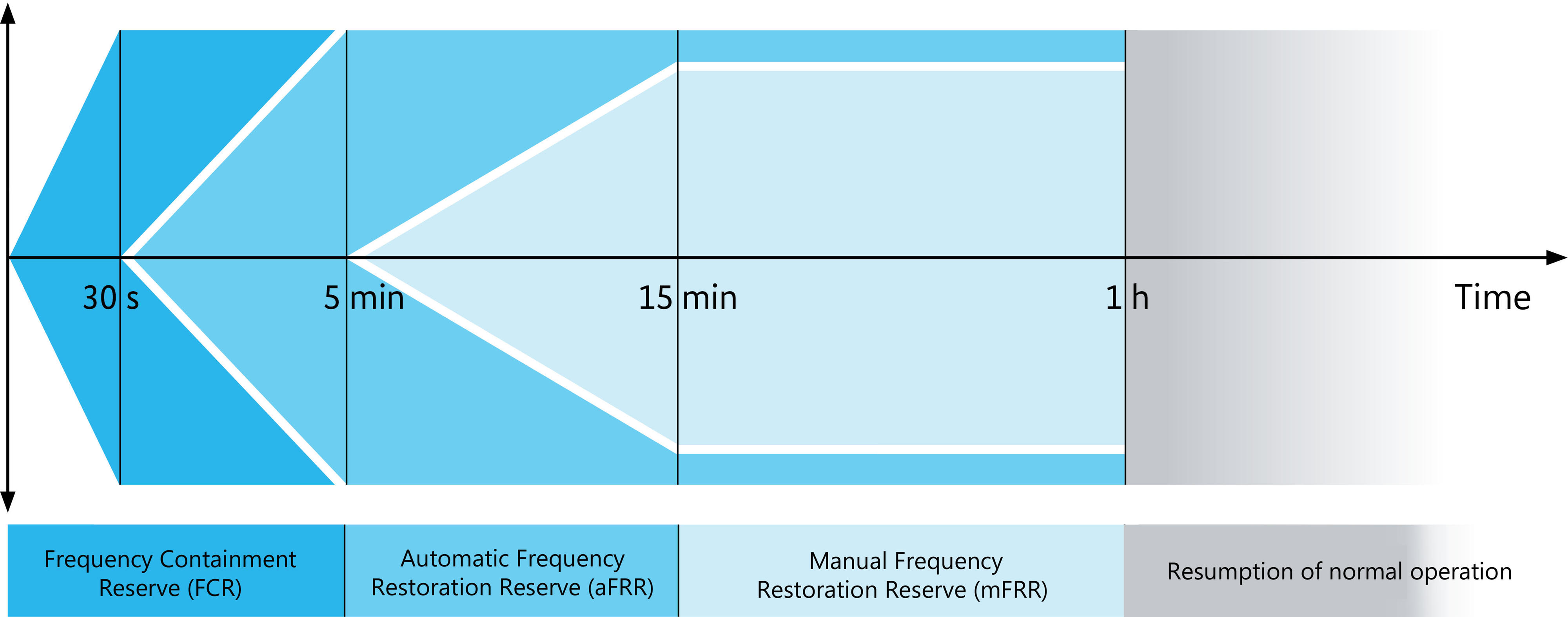

Despite very careful planning, it may happen that the actual consumption in a balancing group does not match generation. In that case, the Transmission system operators correct the imbalance between supply and demand by procuring different types of Balancing services: frequency containment reserves (FCR) must be fully available within 30 seconds, frequency restoration reserves with automatic activation (aFRR) within five minutes and frequency restoration reserves with manual activation (mFRR) within 15 minutes. Transmission system operators also distinguish between positive and negative Balancing services. Positive Balancing services are provided by higher generation or lower consumption, whereas negative Balancing services are provided by lower generation or higher consumption. The use of Balancing services to offset physical deviations between generation and consumption ensures that the discrepancies between the notified schedule and the actual situation are offset throughout the entire balancing zone. The costs of the use of the Balancing services are billed via the Balancing energy system, so if a balancing group does not stick to its schedule overall, it has to bear the costs for the use of Balancing services. The Balancing energy costs therefore act like a penalty payment for deviations from the registered schedule. They provide the key incentive to balance the balancing groups.

The graph shows the time of availability of Balancing services.

The electricity market rewards output and capacity

On the spot markets, only electricity output is explicitly traded. Output means the energy delivered, in kilowatt-hours or megawatt-hours. However, implicitly the electricity market also rewards the provision of capacity on futures markets, spot markets and in electricity purchase contracts. Explicitly, the electricity market rewards capacity, eg on the balancing market and in option and hedging contracts.

Lower-priced generation has priority

Which installation ultimately produces the electricity is determined by merit order in auctions. Merit order refers to the listing of installations by the price which they have specified they are willing to generate electricity for. These prices typically reflect the costs of generation for the installation. Strictly speaking, they are the marginal costs, ie the costs required to generate another electricity unit, which vary depending on the type of installation. Run-of-river plants, solar and wind power plants are the most economical; they have nearly exclusively investment costs and only very low marginal costs. When the water is flowing in the river, the sun is shining or the wind is blowing, they produce electricity. By contrast, conventional power plants have higher marginal costs just because of the fuel they use. They come into play when water, wind and sun alone are not sufficient to meet electricity needs.

Among power plants with higher marginal costs, too, those which produce more cheaply have priority. The price is not fixed until electricity demand has been fully met. It is determined by the installation with the highest marginal costs that gets to feed in electricity. The price is then high enough for this installation to be operated economically and it is good for the other producers, because they get the same price and thus a higher rate of return.

Buyers and consumers do not need to worry about the quality of the electricity since it is a homogeneous good, ie its quality is always the same. As far as quality is concerned, therefore, it makes no difference which supplier a dealer buys from as the grid is synchronous throughout the whole of Europe. The market, on the other hand, is very dynamic and helps all parties to profit from an affordable, secure and environmentally sustainable energy supply.