Hint: This website is not optimized for your browser version.

Energy market topics

Congestion management in the second quarter of 2024

23.10.2024 - The continued growth in renewable energy capacity located relatively far away from demand centres together with the long timescales associated with implementing grid expansion projects are placing pressure on the transmission and distribution networks. With wind plants feeding a large amount of electricity into the grid in the north of the country and large-scale, high-consumption industrial customers located in the southern federal states, the flow of electricity from north to south is so intense that it sometimes exceeds the capacity of the power lines.

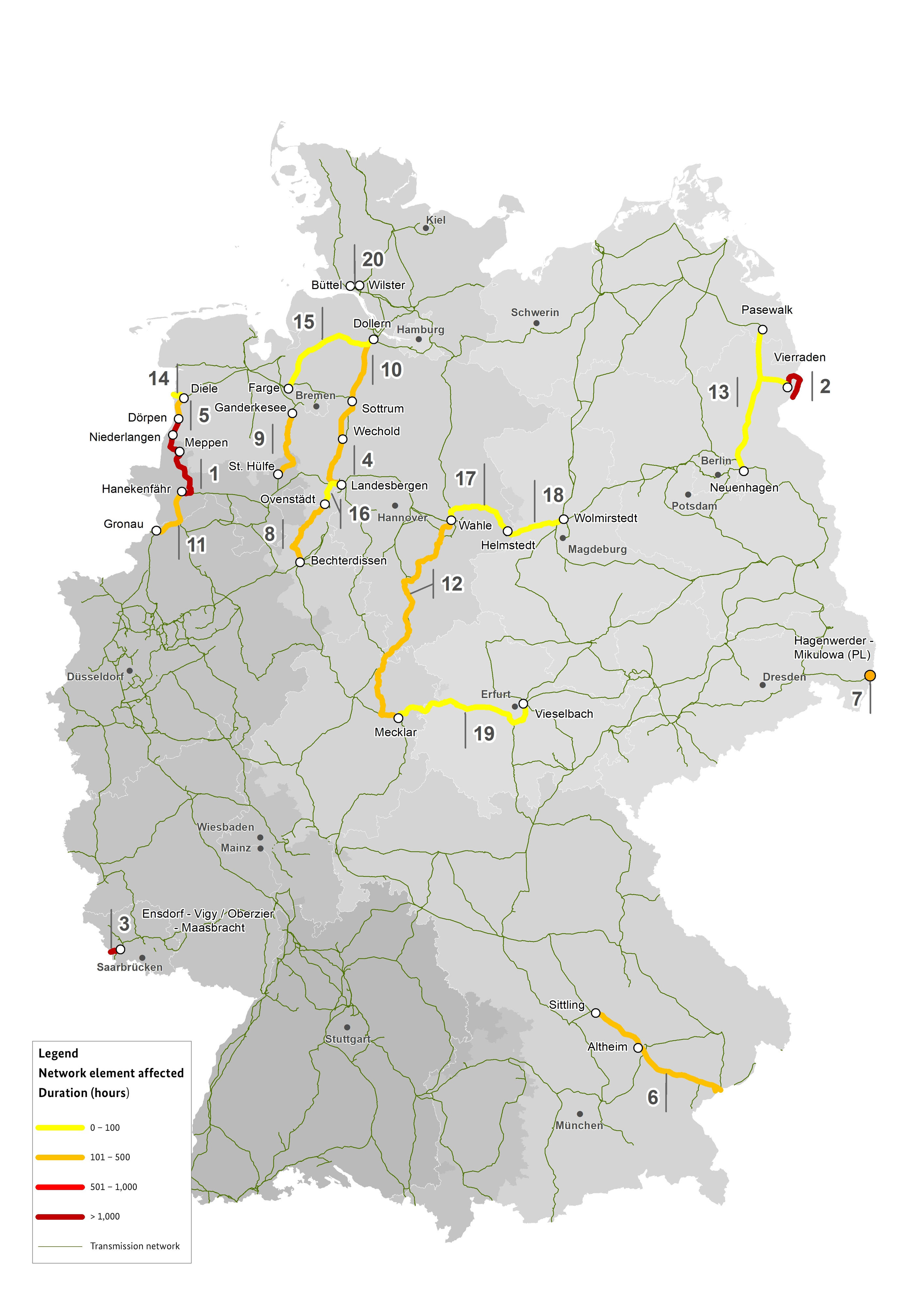

The following map shows which of the transmission system operators' power lines most frequently triggered intervention in the second quarter of 2024:

Significant expansion of the electricity supply networks is already in progress with the aim of preventing network congestion. However, until sufficient progress in expanding the networks has been made, it is sometimes necessary to make changes to where electricity is generated. For instance, a power plant in front of congestion may be instructed to reduce the amount of electricity it generates while another power plant behind the congestion may be instructed to increase the amount it generates. This is known as congestion management.

Volume and costs of congestion management measures lower than a year before

The total volume of the measures taken for congestion management (redispatching with operational and grid reserve power plants and countertrading) fell by about 12% from 7,161 gigawatt hours (GWh) in the second quarter of 2023 to 6,285 GWh in the same quarter of 2024.

The total costs were provisionally put at around €550.4mn and were therefore also lower than in the second quarter of 2023 (€574.4mn).

97% of renewable electricity generated successfully transported to final customers

The reductions and increases in feed-in from operational power plants as part of the redispatching process amounted to around 4,737 GWh in the second quarter of 2024 (Q2 2023: 5,428 GWh). This volume included reductions and increases in feed-in from renewable power plants totalling 2,096 GWh (Q2 2023: 1,838 GWh). Although about 53% of this volume involved renewable energy installations connected to the distribution network, around 71% of the redispatch volume with renewables was due to congestion in the transmission network and about 29% due to congestion in the distribution network.

The total volume of redispatching measures with renewables was around 14% higher than in the second quarter of 2023. Offshore wind had the largest amount of energy curtailed, with 913 GWh, although this was about 9% down on the second quarter of 2023. Solar had curtailments totalling 603 GWh and onshore wind 570 GWh. This corresponds to an increase of 78% in curtailments for solar and an increase of 17% in curtailments for onshore wind compared with the second quarter of 2023.

The increase in curtailed solar and wind onshore generation is due to several factors. There were above-average levels of sunshine in the north and northeast of Germany especially in May and June. In addition, a particularly large number of new solar installations with a combined capacity of 10 gigawatts (GW) had been put into operation since a year earlier. There was also an increase in curtailed wind generation. This was due to an expansion in capacity of just under 2.5 GW and above-average levels of wind generation because of several storms.

In the second quarter of 2024, 5% of the electricity generated by wind was curtailed as a result of current-related and voltage-related congestion. Curtailments for solar represented 2% of the solar electricity generated. Overall, renewable energy curtailments amounted to 3% of the total amount of electricity generated by renewables. This means that 97% of the renewable energy produced was fed into the grid and used by end customers.

The decreases in feed-in as part of the redispatching process were offset by increases in feed-in above all from natural gas (764 GWh) and hard coal-fired (728 GWh) power plants.

In the second quarter of 2024, feed-in from grid reserve power plants totalling about 286 GWh was used to relieve congestion; this was considerably more than the amount of 92 GWh in the same quarter of 2023. The increase was due to the expiry of the Maintenance of Substitute Power Stations Act. While the Act was in force, in particular coal-fired power plants that were part of the grid reserve operated in the electricity market temporarily in order to reduce the volume of gas used to produce electricity. These power plants returned to the grid reserve at the end of the temporary period, which is why more feed-in from grid reserve power plants was needed to stabilise the electricity grid in the second quarter of 2024.

The volume of the countertrading measures taken fell by 23% from 1,641 GWh in the second quarter of 2023 to around 1,261 GWh in the same quarter of 2024. This decrease was due to planned construction work on power lines that led to a reduction in the transmission capacity between Germany and Denmark. In turn, fewer countertrading measures had to be taken to secure this reduced capacity.

Decrease in congestion management costs due in particular to decrease in volumes

The total costs for congestion management measures in the second quarter of 2024 were provisionally put at around €550.4mn (Q2 2023: €574.4mn), corresponding to a decrease of 4%. These costs are made up of the following costs:

The provisional costs for redispatching measures using conventional power plants in the second quarter of 2024 were €217.3mn, representing a significant fall compared with the same quarter of 2023 (€341.4mn). This is mainly due to the decrease of about 26% in the volume of redispatching measures using conventional power plants compared with the second quarter of 2023.

The financial compensation paid to operators of curtailed renewable energy installations increased significantly by 49% to around €161.9mn (Q2 2023: €108.5mn). This is due firstly to the increase in the volume of redispatching measures with renewable installations and secondly to the effect of the lower wholesale prices. When feed-in from direct-selling renewable energy installations is reduced, the installation operators essentially only lose the market premium paid under the Renewable Energy Sources Act (EEG). The market premium is the difference between a certain set price, which represents the primary rate of support for renewable energy, and the monthly average price for electricity on the exchange.

The provisional costs of reserving the grid reserve plant capacity plus costs not dependent on the use of the reserve in the second quarter of 2024 totalled €102.3mn (Q2 2023: €54.4mn). The costs of deploying the grid reserve amounted to about €54.3mn (Q2 2023: €27.7mn). The total costs for the grid reserve were therefore around €156.7mn. The rise in the costs was proportional to the increase in the deployment of the grid reserve power plants and the expiry of the Maintenance of Substitute Power Stations Act.

The costs for countertrading measures in the second quarter of 2024 were about €14.5mn, corresponding to a decrease of 66% (Q2 2023: €42.3mn). This is due firstly to the reduction in the volume of countertrading measures and secondly to the fall in wholesale prices compared with the second quarter of 2023.