Hint: This website is not optimized for your browser version.

Electricity market in the first quarter of 2024

Higher renewable generation

07.05.2024 – In the first quarter of 2024 the share of renewables in German electricity generation (grid feed-in) was 8.2% higher than in the first quarter of 2023. Total electricity generation was 8.1% lower than in the same period of the previous year, with consumption falling by 0.4% (in terms of grid load). The average wholesale price was €67.67/MWh, down 41.6% compared with the first quarter of 2023. Germany was a net importer in commercial foreign trade.

As 2024 is a leap year, 29 February was an additional day in the first quarter, on which electricity consumption (in terms of grid load*) amounted to 1,395 GWh. Nevertheless, overall electricity consumption decreased to 120,640.4 GWh, down 0.4% on the previous year. The residual load declined by 7.4% to 65,164 GWh. This made it possible to cover a higher share of electricity consumption with wind and solar generation.

More than 50% of electricity from renewables

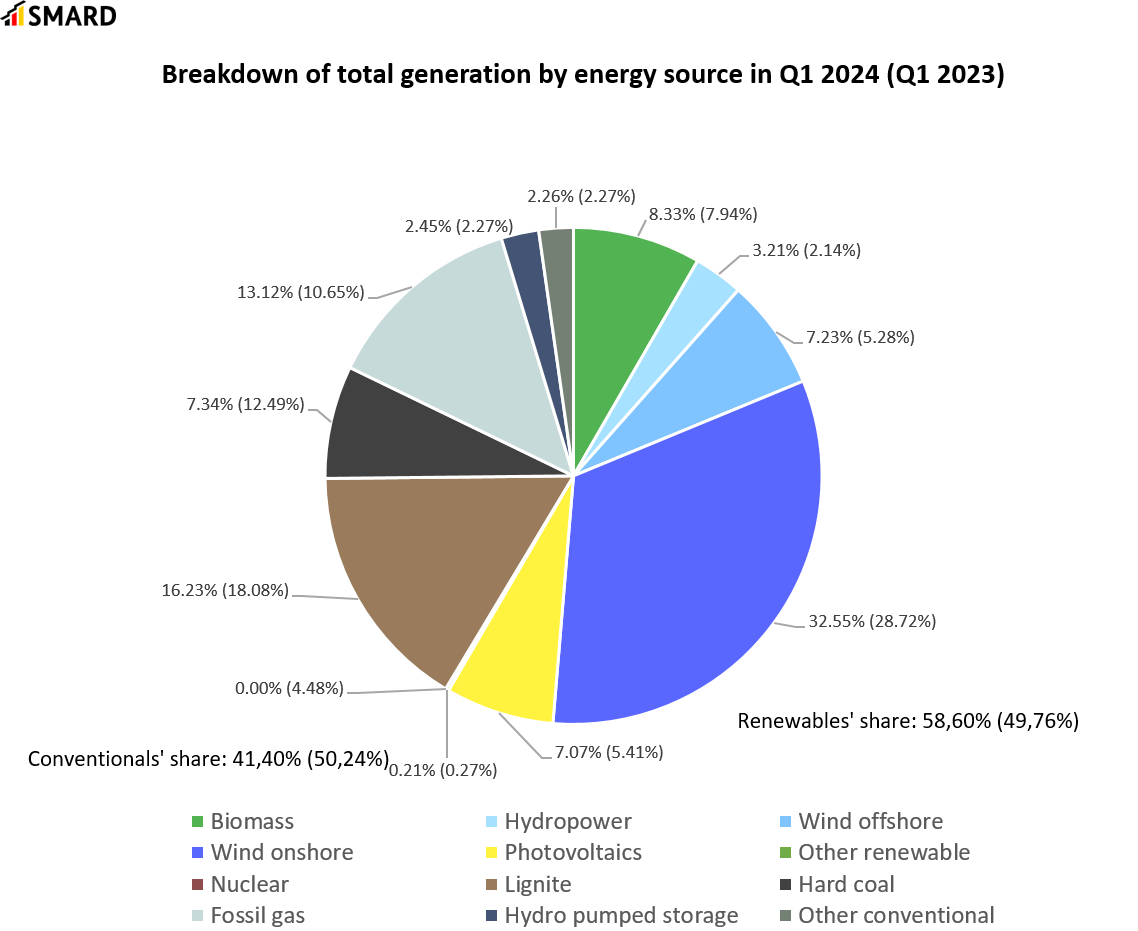

A total of 58.6% of the electricity generated in Germany (grid feed-in) was from renewables, while in the first quarter of 2023 only 49.8% came from renewable sources. This is mainly due to the expansion of generation capacity and the much more favourable weather conditions. In February, in particular, there were above-average levels of precipitation and wind, while January was marked by more sunshine than usual. Another factor is that the previous year was characterised by unfavourable weather conditions and renewable energy output was lower than usual.

Onshore wind accounted for the largest share of all energy sources at 32.6% of the total generation, compared to a share of 28.7% in the first quarter of 2023. A total of 38,517 GWh was generated from onshore wind, up 4.1% on the previous year.

Solar PV also saw an increase, contributing 8,370.3 GWh, which is 20.2% more than in the first quarter of 2023. This was due to an above-average level of sunshine in January and March (DWD) and a comparatively low level of generation in the same quarter of the previous year.

Hydropower saw the largest increase in electricity generation. During the first quarter hydropower generated 3,800.5 GWh, which is 38.2% more than in the same quarter of the previous year and a new record high for the first quarter. This is mainly due to above-average levels of precipitation, in particular in January and February (DWD), which led to higher flow rates in run-of-river power plants and thus to a higher electricity output.

Lower feed-in from conventional energy sources

Electricity generation from lignite and hard coal went down in the first quarter of 2024. The share of hard coal fell by 46.0% year-on-year to 8,688.2 GWh, accounting for 7.3% of total generation. Lignite decreased by 17.5% to 19,199.9 GWh, but still accounted for the second-largest share in total energy output at 16.2%.

During the first quarter of 2024, around 4.5 GW of lignite and hard coal generation capacity was permanently shut down. Total generation from these energy sources decreased at an above-average rate, as other energy sources were usually less expensive in comparison and therefore more frequently successful in the merit order process.

Electricity generation from natural gas increased by 13.2% to 15,526.8 GWh, accounting for 13.1% of total generation. This is partly due to declining gas prices, which returned to a level similar to that prior to the beginning of Russia’s war of aggression against Ukraine. Gas-fired power plants, in particular, benefit from their flexibility, as their output can be increased and decreased quickly to meet higher demand at short notice. In addition, natural gas is used to generate process and district heat in CHP (combined heat and power) plants. With these plants it is not always possible to separate heat generation from electricity generation, which is why operators responsible for supplying municipal heat sometimes continue generating electricity in CHP plants although other energy sources would be more cost efficient than natural gas at that particular point in time. Gas-fired power plants are also used for redispatching and balancing.

An overall total of 118,316.7 GWh of electricity was generated in the first quarter, which was 8.1% less than in the same quarter of the previous year.

Lower wholesale prices

The average wholesale price fell by 41.6% year-on-year to €67.67/MWh. Prices in day-ahead trading were lower than in the same quarter of the previous year in 1,815 of the 2,184 hours in the first quarter of 2024. The number of hours with a wholesale price above €100/MWh also went down significantly, from 1,437 hours in the first quarter of 2023 to only 205 hours in the first quarter of 2024. This trend is mainly due to falling gas prices and higher output from renewables as described above.

The lowest wholesale price was negative €9.98 and was recorded on 10 March between 1pm and 2pm. During this hour generation from renewables (53.1 GWh) was higher than electricity consumption (50.4 GWh).

The highest price (€174.70/MWh) was recorded on Monday 25 March between 7pm and 8pm. During this hour an electricity consumption of 59.3 GWh coincided with a low level of renewable generation of 10.2 GWh.

Day-ahead wholesale electricity prices in Germany | ||

Q1 2024 | Q1 2023 | |

Average [€/MWh] | 67.67 | 115.82 |

Minimum [€/MWh] | -9.98 | -6.02 |

Maximum [€/MWh] | 174.70 | 270.22 |

Number of hours with negative prices | 32 | 23 |

Commercial foreign trade

A total of 12,870.1 GWh of electricity was imported, which is an increase of 51.0% on the previous year. Electricity exports amounted to 10,961.8 GWh, representing a decrease of 33.1%. This means that Germany saw net imports of 1,908.3 GWh in the first quarter of 2024, compared to net exports of 7,862.7 GWh in the first quarter of 2023.

Cross-border trade with Poland experienced significant change. Exports rose by 46.7% to 1,305.2 GWh, while imports went down by 39.1% to 327.1 GWh. In the first quarter of 2024 German wholesale prices were lower than prices in Poland in 1,700 of the 2,184 hours, and exceeded Polish prices in only 293 hours. This is why it made economic sense for Poland to import electricity from Germany most of the time. In the first quarter of 2023, German electricity was less expensive than Polish electricity in 1,333 of the 2,160 hours and exceeded Polish prices in 612 hours. (The difference between the total hours of trading is due to the leap day on 29 February 2024).

The single European market allows electricity to be generated within the interconnected grid wherever it is most economically viable. This helps reduce costs in the interconnected system as a whole. This means that a higher level of electricity imports is not necessarily required to meet demand.

An overview of Germany's commercial foreign trade in electricity in Q1 2024:

- Belgium:

Exports: 600.3 GWh Imports: 863.3 GWh - Denmark 1:

Exports: 817.0 GWh Imports: 2,290.2 GWh - Denmark 2:

Exports: 393.6 GWh Imports: 934.1 GWh - France:

Exports: 1,182.8 GWh Imports: 3,286.2 GWh - Netherlands:

Exports: 936.4 GWh Imports: 1,385.6 GWh - Norway:

Exports: 515.7 GWh Imports: 1,371.7 GWh - Austria:

Exports: 2,673.9 GWh Imports: 358.1 GWh - Poland:

Exports: 1,305.2 GWh Imports: 327.1 GWh - Sweden

Exports: 131.2 GWh Imports: 569.3 GWh - Switzerland:

Exports: 1,176.7 GWh Imports: 1,023.9 GWh - Czechia:

Exports: 1,229.0 GWh Imports: 460.6 GWh

________________________________________________________________________

* The grid load is calculated by taking the net electricity generation, subtracting transmission capacity exports, adding transmission capacity imports and subtracting the pumping work at pumped storage power stations. The grid load does not include power stations' own consumption or industrial networks, so the calculation basis applied here – compared with the share of gross electricity consumption – typically results in a higher proportion of generation from renewables.