Hint: This website is not optimized for your browser version.

Analysis of the past quarter

Electricity market in the fourth quarter of 2022

17 January 2023 - In the last quarter of 2022, electricity consumption was 8.6% lower than in the same quarter of 2021. As feed-in from renewables was up by 3.0%, the proportion of electricity consumption covered by renewables was also higher, at 46.0%. The average wholesale electricity price was €192.81/MWh, and Germany was a net exporter of electricity.

Electricity consumption in October 10.4% lower than 2021

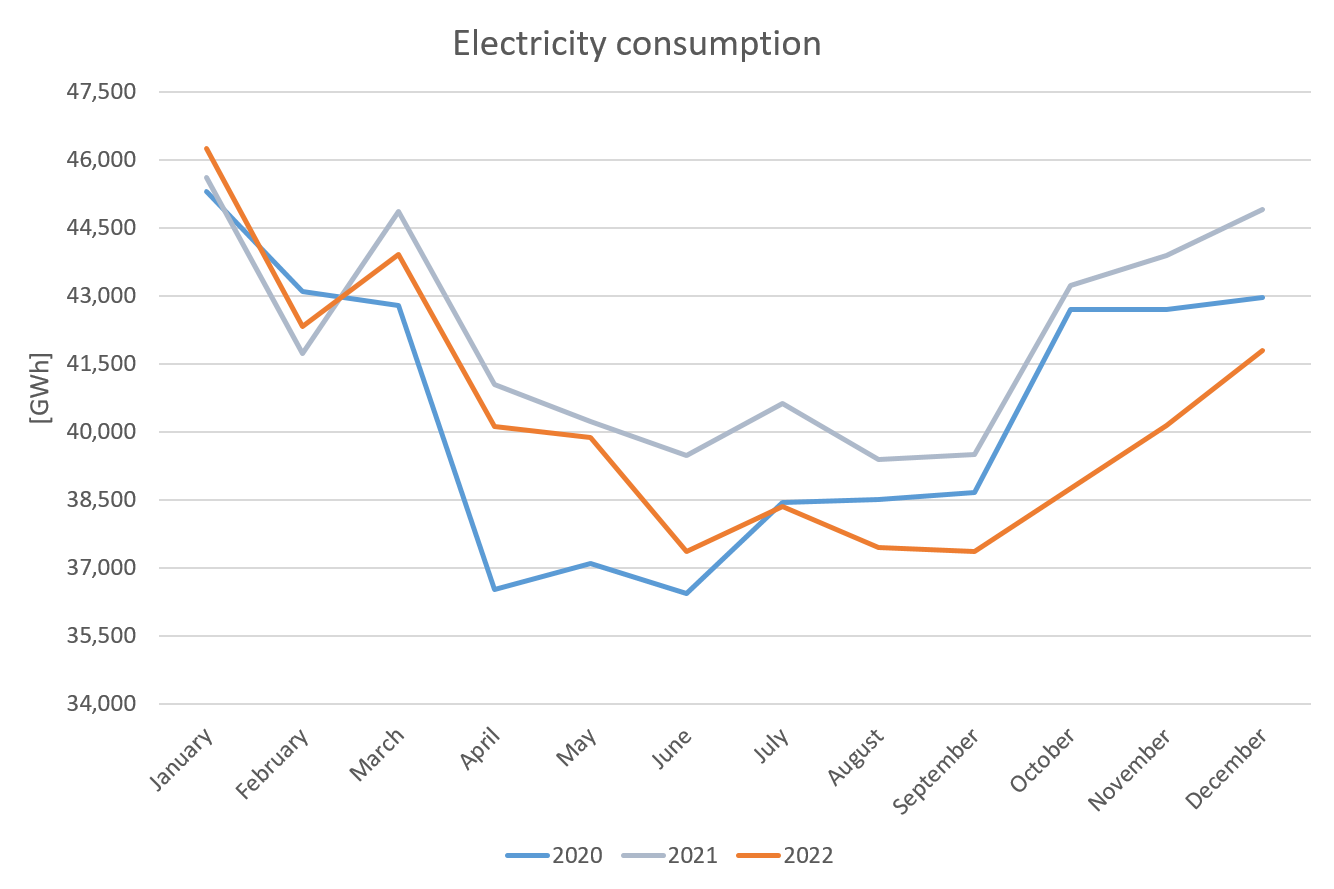

Electricity consumption was slightly higher than in 2021 at the beginning of 2022 but in the following months it fell steadily. Consumption was considerably lower in the fourth quarter of 2022, down 8.6% on the same quarter of 2021. The biggest year-on-year decrease was in October (down 10.4%), while in November the decline was 8.5% and in December 6.9%. Overall, electricity consumption was lower than in 2020, when the coronavirus pandemic began, with consumption falling and remaining below 2020 levels as from July.

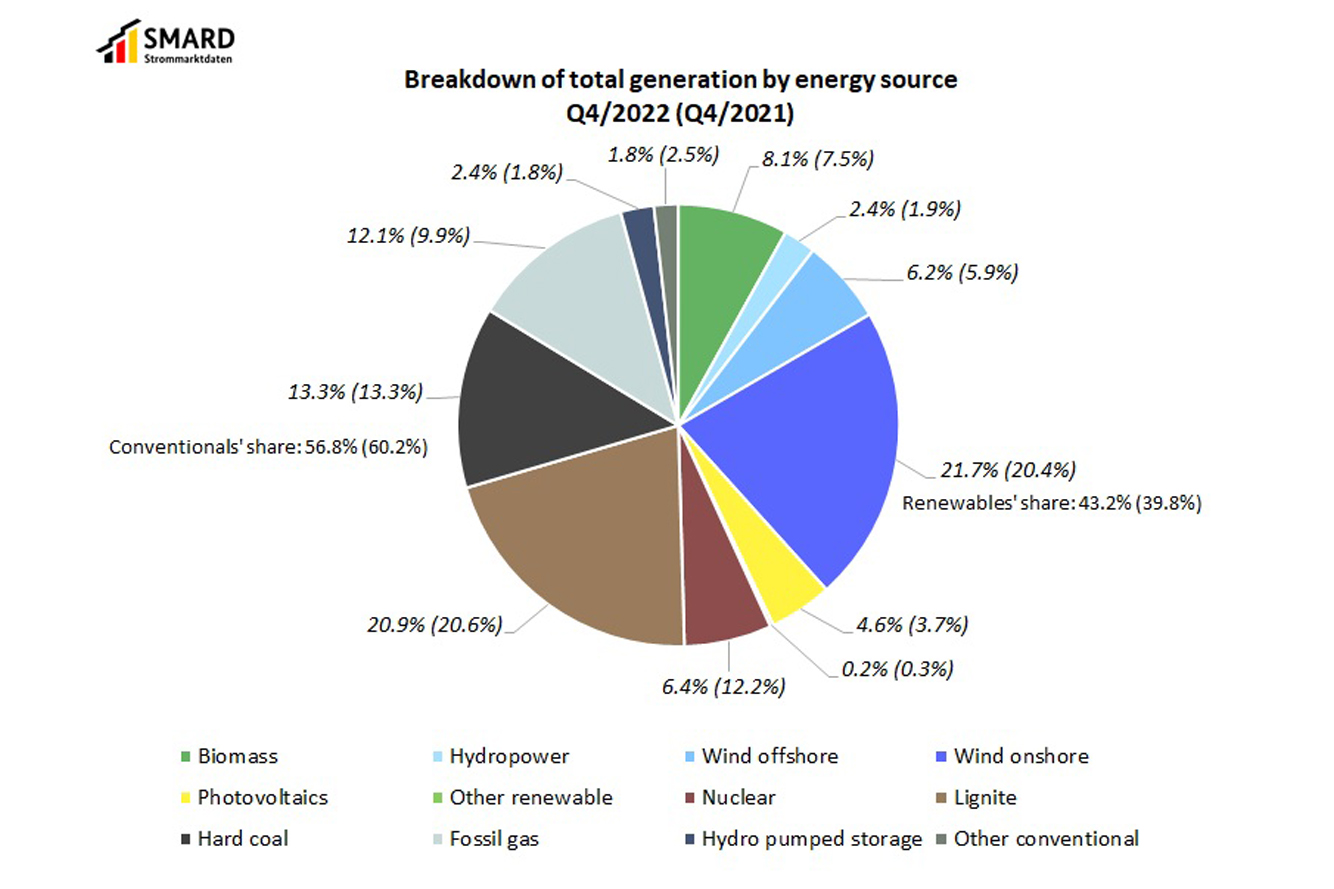

Feed-in from renewables in the last three months of 2022 was 3.0% higher than a year earlier, while feed-in from conventional sources was 10.3% lower. As a result, the proportion of electricity consumption covered by renewables was 46.0%. Overall, electricity generation in Germany was 5.0% lower than in the fourth quarter of 2021.

Among the renewable energy sources, there was a particularly large increase in feed-in from photovoltaic installations, up 17.2% on the last quarter of 2021. This is partly due to the increase in installed generating capacity and partly due to the favourable weather conditions, especially in November.

Hydropower generation in the last quarter of 2022 was 16.9% higher than in the same quarter of 2021, when maintenance work resulted in a decrease in generation.

There were also increases in biomass (up 2.2%) and onshore wind (up 0.9%) generation. There was a slight decrease of 0.6% in offshore wind generation. The biggest decrease was in feed-in from other renewables (down 26%), but with 310.7 MWh these only make up a small proportion of total generation.

Among the conventional energy sources, nuclear power generation was 50.2% lower than in the same quarter of 2021. This downward trend was also visible in the previous quarters and is due to the decommissioning of individual plants at the end of 2021. In addition, the Isar 2 nuclear power station, with an installed generation capacity of 1,410 MW, was offline for several days in October because of maintenance work.

Generation from hard coal was 5.0% lower and generation from lignite 3.7% lower in the last quarter of 2022, even though some coal-fired plants returned to the market. Although generation was lower, the shares of hard coal and lignite in total generation were more or less unchanged, as shown in the chart. The biggest increase was in generation from pumped storage stations, which was up 32.0%. Their share of total generation increased from 1.8% in the last quarter of 2021 to 2.4% in the same quarter of 2022. Generation using natural gas was 15.8% higher and the share in total generation increased to 12.1% (2021: 9.9%).

One reason for the continued use of gas power plants is their flexibility. They can be switched off and fired up again much faster than coal or nuclear plants, which offers advantages if higher demand for electricity needs to be met at short notice. Gas-fired power plants can also be helpful, and in some cases essential, for redispatching and balancing. The great flexibility of gas power plants can be seen in their feed-in time series.

Natural gas is used to generate process and district heat and, for technical reasons, electricity is often produced at the same time. From the operators' perspective, it makes sense for combined heat and power (CHP) plants to continue producing electricity if they are responsible for supplying heat to an urban or industrial heating network and if it is not yet possible – or would be more expensive – to separate the heat generation from the electricity generation process. They would therefore need to make their own efforts to replace natural gas for heat production with other energy sources.

Long-term gas purchasing agreements, in which the gas had to be used in gas-fired power plants or paid for anyway even if it was not taken, also led to economic incentives to use gas in electricity production in the past. Amendments to the Energy Industry Act (EnWG) removed these restrictions on use and now permits the gas to be injected into storage as well.

Wholesale prices for electricity

Following Russia's invasion of Ukraine, there was a huge increase in prices on the wholesale markets for electricity, gas and coal. Electricity prices were extremely volatile and closely connected to gas price trends, which in turn were highly dependent on developments in the Ukraine crisis and Russia's steps to escalate it with regard to supplying gas to Germany and Europe. However, market reactions were not always rational and supported by sound fundamental data. The Bundesnetzagentur publishes daily status reports on the supply of gas in Germany here.

The main reason for the higher prices for electricity over the year is the increase in natural gas prices that occurred in the second half of 2021. Natural gas power plants set the price for many hours in European wholesale electricity trading.

The average wholesale electricity price in Germany in the last quarter of 2022 was €192.81/MWh and again higher than in the same quarter of the previous year (€178.91/MWh), despite twice as many hours with negative prices. The average price was, however, considerably lower than in the third quarter (€375.75/MWh) and close to the level of 2021.

At €139.49/MWh, the lowest average price in the quarter was in October. One of the reasons for the low price was the electricity consumption level, which was low for October and down 9.4% year-on-year. At the same time, renewables took a large share of total generation and correspondingly accounted for 48.8% of consumption. Moreover, in the last quarter of the year some coal power stations returned to the market, increasing generating capacity and thus the supply on the wholesale electricity market. Generating costs for gas power plants were also lower in October after natural gas prices had fallen.

The highest price (€665.01/MWh) was recorded between 5pm and 6pm on Tuesday 13 December. The average wholesale electricity price in Germany's neighbouring countries in this hour was €612.49/MWh. The high price in Germany was due to the high amount of generation during this hour from conventional energy sources (60.3 GWh), which covered a large share of the electricity consumption (71.0 GWh). In this hour, Germany exported 4.7 GWh more electricity than it imported.

Day-ahead wholesale electricity prices in Germany | ||

Q4 2022 | Q4 2021 | |

Average [€/MWh] | 192.81 | 178.91 |

Minimum [€/MWh] | -3.78 | -2.02 |

Maximum [€/MWh] | 665.01 | 620.00 |

Number of hours with negative prices | 29 | 12 |

The lowest price of negative €3.78/MWh was recorded between 12pm and 1pm on Saturday 31 December. During this hour, renewable feed-in was 47.5 GWh and consumption was 51.9 GWh. During the same period, the average price in Germany's neighbouring countries was €23.97/MWh and Germany exported 11.2 GWh (net).

In the last quarter of 2022, the average price in Germany's neighbouring countries was €190.04/MWh and thus slightly lower than Germany's average price (€192.81/MWh).

Decrease in imports and exports

In the last quarter of 2022, Germany exported 7,325.8 GWh more electricity than it imported, making it a net exporter. Total net exports were lower than in the same quarter of 2021 (8,353.6 GWh). Although imports decreased from 6,839.3 GWh to 4,256.6 GWh, exports also fell from 15,192.9 GWh to 11,582.4 GWh, resulting in a lower balance overall.

Germany was a net exporter of electricity to:

- France, with 3,761.9 GWh (Q4 2021: 4,485.2 GWh)

- Austria, with 3,722.7 GWh (Q4 2021: 6,863.7 GWh)

- Switzerland, with 1,564.9 GWh (Q4 2021: 1,435.3 GWh)

- Luxembourg, with 970.0 GWh (Q4 2021: 1,048.3 GWh)

- Poland, with 535.1 GWh (Q4 2021: net imports of 1,154.2 GWh)

- Belgium, with 533.4 GWh (Q4 2021: 511.1 GWh)

- Czechia, with 494.4 GWh (Q4 2021: net imports of 569.7 GWh).

Germany was a net importer of electricity from:

- Denmark 1, with 1,769.7 GWh (Q4 2021: 2,618.4 GWh)

- Norway, with 1,019.9 GWh (Q4 2021: 627.4 GWh)

- Sweden, with 615.1 GWh (Q4 2021: 853.5 GWh)

- Netherlands, with 427.5 GWh (Q4 2021: net exports of 849.3 GWh)

- Denmark 2, with 424.4 GWh (Q4 2021: 1,016.1 GWh).

Germany's net imports in trade with the Denmark 2 market area more than halved due to changes in the wholesale prices. In the last quarter of 2021, it made economic sense for Germany to import electricity from the market area at an average price of €144.78/MWh. Electricity from the market area was cheaper than in Germany in 1,195 of the 2,209 hours of trading. In the same quarter of 2022, that was the case in just 748 hours, and the average price in the Denmark 2 market area (€177.24/MWh) was only slightly lower than Germany's price.