Hint: This website is not optimized for your browser version.

Analysis of the past quarter

Renewables' share of generation high

08 April 2022 – In the first quarter of 2022, electricity consumption was 3.4% lower and total electricity generation 3.9% higher than in the first quarter of 2021. The average wholesale electricity price was €184.62/MWh, and Germany was a net exporter of electricity.

Renewables' share of electricity generation at 47.9%

In the first quarter of this year, total electricity consumption (grid load) was 127.7 terawatt hours, 3.4% lower than in the first quarter of 2021. Monthly consumption was highest in January at 44.9 TWh, followed by March with 42.4 TWh, and February with an even lower consumption of 41.7 TWh. February is usually the month with the lowest consumption in the quarter because it has fewer working days.

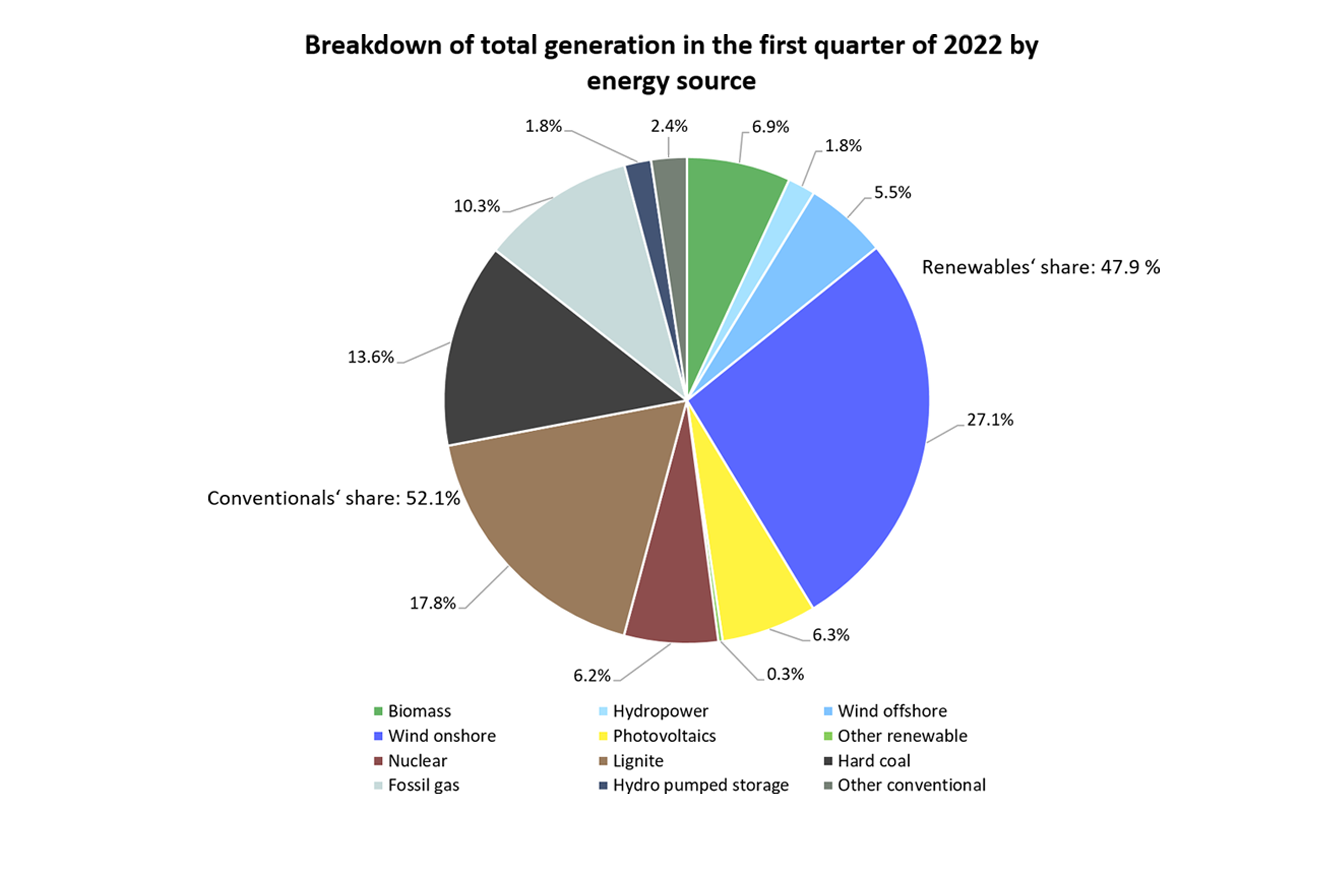

Total electricity generation was 3.9% higher than in the first quarter of 2021. Renewable generation was up 20.8% and conventional generation down 8.1% on 2021. Renewables' share of total generation was consequently high at 47.9%.

A breakdown by energy source shows that the high renewable generation was driven in particular by wind generation. Total wind generation in the first quarter was 44.8 TWh (Q1 2021: 34.2 TWh). Offshore wind generation was up around 2.2% and onshore wind up around 38.8%. This was due in particular to several storms in February.

Solar photovoltaic generation was the highest for any first quarter, one reason being the sunniest March since records began (national meteorological office – DWD). Total solar PV generation in the first quarter was 8.7 TWh, 29.2% higher than in the first quarter of 2021. Hydro generation was down 19.7% and biomass down 4.9%. This was due to less capacity being available because of maintenance and modernisation work.

The 8.1% decrease in conventional generation is partly due to power plant closures. Three nuclear, three lignite-fired and three hard coal-fired power plants were all shut down at the end of December 2021. This resulted in a reduction in the installed generation capacity of around 4.1 GW for nuclear and 2.5 GW for coal. Nuclear generation was consequently lower, down 48.9% compared to the first quarter of 2021. Generation from lignite was 4.9% lower, while generation from hard coal was 55.9% higher. Electricity generation from natural gas was 19.0% lower, one particular reason being the higher cost of fuel. The actual cost benefit of gas power plants – because of the fact that they need fewer carbon allowances – was outweighed by the high cost of gas.

Renewables' highest share of the daily grid load was on Sunday 20 February. Renewables covered 93.0% of the consumption that day, which was one of the days when the above-mentioned storms occurred. Onshore and offshore wind generation had the highest contribution, with around 936 GWh. Renewables also covered the total consumption (grid load) in six consecutive hours that day.

Increase in wholesale prices

Since the invasion of Ukraine, there has been another huge increase in prices on the wholesale markets for electricity, gas and coal, and prices have been extremely volatile and dependent on developments in the Ukraine crisis. News or rumours very quickly lead to movements in prices that can be corrected to some degree again a short time later. There are concerns about, for instance, technical disruptions to pipeline transports through Ukraine because of the hostilities, Russia stopping deliveries, and countries stopping imports from Russia.

The average wholesale price in Germany over the three months was 184.62 euros per megawatt hour, which was above the average of €49.59/MWh in the first quarter of 2021. The main reason for the higher prices is the increase in natural gas prices that already occurred in the second half of 2021.

The lowest price in the first quarter of 2022 was negative €19.04/MWh and was recorded between 1pm and 2pm on Sunday 20 March, during the storms. During this hour renewable generation was higher than the consumption (grid load).

The highest price was €700.00/MWh and was recorded between 7pm and 8pm on Tuesday 8 March, when an electricity consumption of 64.4 GWh coincided with renewable generation of 21.7 GWh. Conventional generation was 43.6 GWh, and Germany was a net exporter. The average price in neighbouring countries was €562.62/MWh, with the lowest average price of €250.08/MWh in the Sweden 4 and Norway 2 bidding zones.

Day-ahead wholesale prices in Germany | ||

Q1 2022 | Q1 2021 | |

Average [€/MWh] | 184.62 | 49.59 |

Minimum [€/MWh] | -19.04 | -49.99 |

Maximum [€/MWh] | 700.00 | 136.71 |

Number of hours with negative prices | 14 | 9 |

Germany net exporter in commercial foreign trade

The average price in Germany's neighbouring countries in the first quarter of 2022 was €182.80/MWh and slightly lower than Germany's average. The highest average price was €245.85/MWh and in Switzerland, and the lowest average price was €111.36/MWh and in the Sweden 4 bidding zone.

Germany was a net exporter of electricity to:

• Austria, with 6,794.6 GWh (Q1 2021: 5,653 GWh)

• France, with 6,079.3 GWh (Q1 2021: 1,868.7 GWh)

• Switzerland, with 1,288.4 GWh (Q1 2021: 1,837.6 GWh)

• the Netherlands, with 1,082.9 GWh (Q1 2021: net imports of 491.4 GWh)

• Luxembourg, with 1,041.5 GWh (Q1 2021: 1,020 GWh)

• Belgium, with 918.8 GWh (Q1 2021: 177.2 GWh)

• Czechia, with 577.5 GWh (Q1 2021: net imports of 139.0 GWh).

Germany was a net importer of electricity from:

• Denmark 1, with 2,168.2 GWh (Q1 2021: 1,749.9 GWh)

• Denmark 2, with 1,085.3 GWh (Q1 2021: 170.1 GWh)

• Sweden, with 901.6 GWh (Q1 2021: 296.7 GWh)

• Norway, with 771.9 GWh (Q1 2021: 431.1 GWh)

• Poland, with 743.8 GWh (Q1 2021: net exports of 88.6 GWh).

Overall, Germany exported 12,112 GWh more electricity than it imported, making it a net exporter. Net imports in the first quarter of 2021 had totalled 7,367 GWh.

The increase in net exports to France from 1,868.7 GWh in the first quarter of 2021 to 6,079.3 GWh in the first quarter of 2022 is mainly due to the wholesale prices. While prices in Germany and France were the same in 602 hours of the 2,159 hours of trading, the price in Germany was lower than in France in 1,464 hours (Q1 2021: 907 hours), making it cheaper for France to import electricity from Germany.

The reason for the higher prices in France was the decrease of 7.7% in nuclear generation, which accounts for a large part of the country's generation capacity (source: ENTSO-E).

The decrease was due to several nuclear plants not being available in the first quarter because of maintenance and modernisation work.

In turn, for the same reasons it was cheaper for Germany to import electricity from Sweden, where fossil fuels account for a small share of total generation, making the wholesale price cheaper. In the first quarter of 2022, the price in Sweden was lower than in Germany in 1,786 hours (Q1 2021: 929 hours), and prices were the same in both countries in 277 hours (Q1 2021: 740 hours).

A comparison of the figures for trading with Norway needs to take account of the fact that the NordLink interconnector was in trial operation for some of the first quarter of 2021 (up to 12 April 2021) but in full operation throughout the first quarter of 2022.