Hint: This website is not optimized for your browser version.

Congestion management in the third quarter of 2024

Lower volume and costs

16.01.2024 - The volume of congestion management measures fell by about 22% compared with the third quarter of 2023. This led to a decrease of 17% in the provisional costs.

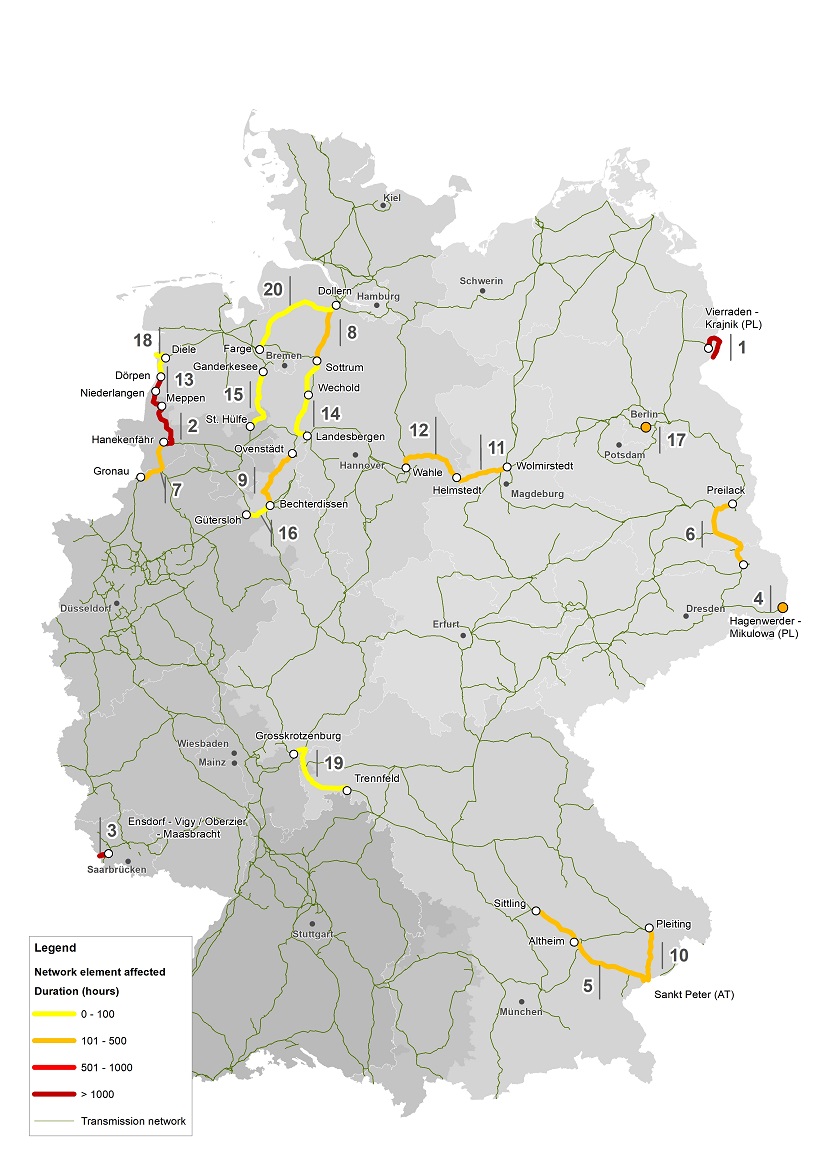

The continued growth in renewable energy capacity located relatively far away from demand centres together with the long timescales associated with implementing grid expansion projects are placing pressure on the transmission and distribution networks. With wind plants feeding a large amount of electricity into the grid in the north of the country and large-scale, high-consumption industrial customers located in the southern federal states, the flow of electricity from north to south is so intense that it sometimes exceeds the capacity of the power lines. The following map shows which of the transmission system operators’ power lines most frequently triggered intervention in the third quarter of 2024:

Significant expansion of the electricity supply networks is already in progress with the aim of preventing network congestion. However, until sufficient progress in expanding the networks has been made, it is sometimes necessary to make changes to where electricity is generated. For instance, a power plant in front of congestion may be instructed to reduce the amount of electricity it generates while another power plant behind the congestion may be instructed to increase the amount it generates. This is known as congestion management.

Volume and costs of congestion management measures lower than a year before

The total volume of the measures taken for congestion management (redispatching with operational and grid reserve power plants and countertrading) fell from 6,712 gigawatt hours (GWh) in the third quarter of 2023 to 5,261 GWh in the same quarter of 2024. The total costs were provisionally put at around €522mn and were therefore also lower than in the third quarter of 2023 (€627mn).

97% of renewable electricity generated successfully transported to final customers

The reductions and increases in feed-in from operational power plants as part of the redispatching process amounted to around 4,068 GWh in the third quarter of 2024 (Q3 2023: 5,325 GWh). This volume included reductions in feed-in amounting to 2,710 GWh and redispatching measures involving renewable power plants totalling 1,858 GWh (Q3 2023: 1,957 GWh). Although about 53% of this volume involved installations connected to the distribution network, around 64% of the redispatch volume with renewables was due to congestion in the transmission network and about 36% due to congestion in the distribution network.

The total volume of redispatching measures with renewables was around 5% lower than in the third quarter of 2023. This decrease is mainly accounted for by installations connected to the transmission network (Q3 2023: 1,104 GWh; Q3 2024: 819 GWh). The reason is the expansion of the grid, with new sections of power lines being put into operation that help reduce north-south congestion.

Reductions in feed-in from installations connected to the distribution network increased from 853 GWh in the third quarter of 2023 to 993 GWh. There was a particularly large increase in curtailments in solar feed-in, from 232 GWh in the third quarter of 2023 to 589 GWh in the same quarter of 2024. This is mainly due to above-average sunshine levels during this period and the continuing increase in new solar capacity. Germany’s national meteorological service, the Deutscher Wetterdienst, reported above-average levels of sunshine in all three months of the quarter, with levels in August as much as around 25% above the long-term average. Despite this, curtailments for solar represented just 2% of the solar electricity generated.

Overall, renewable energy curtailments amounted to 3% of the total amount of electricity generated by renewables. This means that 97% of the renewable energy produced was fed into the grid and used by end customers.

The reductions and increases in feed-in from operational power plants as part of the redispatching process amounted to around 4,068 GWh in the third quarter of 2024 (Q3 2023: 5,325 GWh). This volume included reductions in feed-in amounting to 2,710 GWh and redispatching measures involving renewable power plants totalling 1,858 GWh (Q3 2023: 1,957 GWh). Although about 53% of this volume involved installations connected to the distribution network, around 64% of the redispatch volume with renewables was due to congestion in the transmission network and about 36% due to congestion in the distribution network.

The total volume of redispatching measures with renewables was around 5% lower than in the third quarter of 2023. This decrease is mainly accounted for by installations connected to the transmission network (Q3 2023: 1,104 GWh; Q3 2024: 819 GWh). The reason is the expansion of the grid, with new sections of power lines being put into operation that help reduce north-south congestion.

Reductions in feed-in from installations connected to the distribution network increased from 853 GWh in the third quarter of 2023 to 993 GWh. There was a particularly large increase in curtailments in solar feed-in, from 232 GWh in the third quarter of 2023 to 589 GWh in the same quarter of 2024. This is mainly due to above-average sunshine levels during this period and the continuing increase in new solar capacity. Germany’s national meteorological service, the Deutscher Wetterdienst, reported above-average levels of sunshine in all three months of the quarter, with levels in August as much as around 25% above the long-term average. Despite this, curtailments for solar represented just 2% of the solar electricity generated.

Overall, renewable energy curtailments amounted to 3% of the total amount of electricity generated by renewables. This means that 97% of the renewable energy produced was fed into the grid and used by end customers.

The volume of the countertrading measures taken fell by 32% from 1,303 GWh in the third quarter of 2023 to around 884 GWh in the same quarter of 2024, mainly due to the completion of some network expansion measures.

Decrease in congestion management costs due in particular to decrease in volumes

The total costs for congestion management measures in the third quarter of 2024 were provisionally put at around €522mn (Q3 2023: €627mn), corresponding to a decrease of 17%. These costs are made up as follows:

The provisional costs for redispatching measures using conventional power plants in the third quarter of 2024 were €181mn, representing a significant fall compared with the same quarter of 2023 (€360mn). This is due to the large decrease in the volume of redispatching measures using conventional power plants compared with the third quarter of 2023.

The financial compensation paid to operators of curtailed renewable energy installations amounted to around €126mn, which is similar to the third quarter of 2023 (€123mn) despite the decrease in the volume. This is a result of the fall in wholesale prices. When feed-in from direct-selling renewable energy installations is reduced, the installation operators essentially only lose the market premium paid under the Renewable Energy Sources Act (EEG). The market premium is the difference between a certain set price, which represents the primary rate of support for renewable energy, and the monthly average price for electricity on the exchange.

In the third quarter of 2024 the provisional costs of reserving the grid reserve plant capacity plus costs not dependent on the use of the reserve totalled €129mn (Q3 2023: €72mn). The costs of deploying the grid reserve amounted to about €70mn (Q3 2023: €24mn). The total costs for the grid reserve were therefore around €199mn. The rise in the costs was proportional to the increase in the deployment of the grid reserve power plants and the expiry of the Maintenance of Substitute Power Stations Act.

The costs for countertrading measures in the third quarter of 2024 were about €15mn, corresponding to a decrease of 69% (Q3 2023: €48mn). This is due firstly to the reduction in the volume of countertrading measures and secondly to the fall in wholesale prices compared with the third quarter of 2023.