Hint: This website is not optimized for your browser version.

Energy market topics

The balancing energy market has started

Germany launched the balancing energy market on 2 November 2020. Unlike under the former awards procedure, delivery of balancing energy is now possible without prior participation in the respective capacity auction.

Balancing services quickly correct any deviations

For a stable electricity grid, the system frequency must always be at 50 Hz. This value fluctuates, however, whenever there is an imbalance between electricity generation and electricity consumption. Balancing services provided by transmission system operators help to restore the balance and maintain a steady system frequency. Transmission system operators differentiate between three types of balancing services: frequency containment reserves (FCR) must be fully available within 30 seconds, automatic frequency restoration reserves (aFRR) within five minutes and manual frequency restoration reserves (mFRR) within 15 minutes.

Positive balancing services are provided by increasing electricity generation or reducing consumption when consumption exceeds generation. Negative balancing services are provided by reducing electricity generation or increasing consumption when electricity generation exceeds consumption.

The current design of the tendering process

Through 1 November 2020 Germany used a joint process for the procurement of aFRR and mFRR. This meant that when submitting their bid, providers had to offer a capacity price and an energy price for the balancing service product that had been put out to tender. The capacity price (euros per megawatt) provides remuneration for the willingness to reserve positive or negative balancing capacity for a certain amount of time (validity period). The costs of procuring this reserve capacity are borne by the electricity consumers through the network charges.

The chart illustrates the procured volumes of aFRR and mFRR, as well as the corresponding capacity prices in Germany.

Billing for the balancing energy actually used by the transmission system operators is based on the energy price (euros per megawatt hours) bid. The energy costs are passed on through the imbalance price to the parties causing the activation of the balancing energy. These are balance responsible parties (BRPs) who have contributed to a discrepancy in the system balance (control area balance) through imbalances between generation and purchase on the one side, and consumption and sale on the other side.

To decide which providers are awarded a contract under the current capacity price process, the capacity price bids are sorted in ascending order until the tendered megawatt amount has been reached (merit order). Unlike on the EPEX Spot day ahead market, for example, the providers with successful bids do not get a uniform marginal price (pay-as-cleared), but rather the capacity price they each bid (pay-as-bid). The energy price bid is not relevant for the awards in the capacity market; it only plays a role later in the order in which balancing energy is activated.

Activation of the balancing energy actually needed is determined on the basis of the energy price merit order. The providers with the lowest energy price paid by the transmission system operators are activated first. Payment for the volume activated is based on the individual balancing energy price bid.

The chart illustrates the activated volumes of aFRR and mFRR in Germany.

Changes due to the balancing energy market

The obligation to introduce a balancing energy market stems from EU law (Commission Regulation (EU) 2017/2195establishing a guideline on electricity balancing and Regulation (EU) 2019/943 on the internal market for electricity). The framework of the balancing market proposed for Germany by the transmission system operators was approved by the Bundesnetzagentur on 2 October 2019 (BK6-18-004-RAM).

Since 2 November 2020, tendering for aFRR and mFRR is done in two separate markets; delivering balancing energy is now possible without prior participation in a capacity auction. The design of the tendering process is as follows:

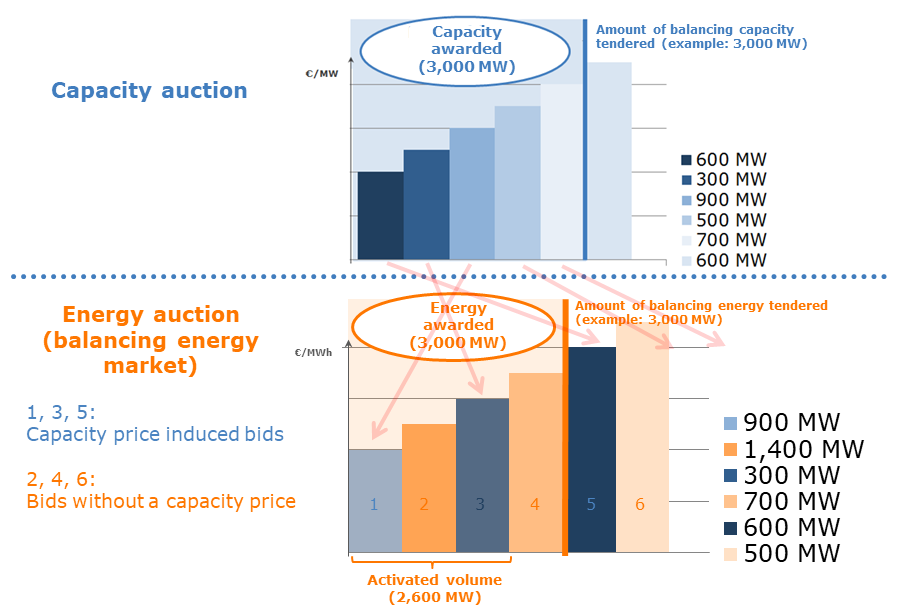

Procurement of balancing capacity starts with a capacity auction. Similar to how the current market is designed, the capacity prices bid are sorted in ascending order until the amount tendered (in megawatts) has been reached. Sorting is randomly decided in the event of identical capacity prices. Not until the subsequent balancing energy auction do providers with successful capacity bids have to place a balancing energy bid. They otherwise automatically participate in the balancing energy market at a price of €0/MWh. Obligatory participation ensures the liquidity of the balancing energy market.

All pre-qualified aFRR and mFRR providers can participate in the relevant energy auctions. Balancing energy bids are also awarded on the merit order principle from the perspective of the transmission system operators. If several bids have the same energy price, the successful bid will be decided randomly. Leftover energy bids will subsequently be cleared for marketing elsewhere, for instance on the intraday power exchange (continuous intraday trading). This serves the purpose of minimising negative effects on liquidity on the power exchange.

As a result, balancing energy activated by the transmission system operators can now also include bids without a capacity price if their providers were able to secure one of the top spots in the merit order by offering low energy prices.

Source: Ruling Chamber 6, Bundesnetzagentur

The chart illustrates the difference between a capacity auction and an energy auction using a balancing service requirement as an example. Under the new market design, participation in an energy auction is possible without having previously bid in a capacity auction. This means activated balancing energy can also include bids without a capacity price.

Balancing capacity market as an insurance product

A special arrangement takes effect if, at any given moment within the final hour of an auction, it is not possible to place or adjust energy bids, or if, for technical reasons, the transmission system operators cannot transmit the award results to external systems. In these rare instances the successful balancing capacity market bids will be used.

All balancing energy bids made prior to the disruption lose their validity. Balancing energy will then only be delivered by the providers who successfully bid in the capacity auction. When the balancing energy is activated, payment will be based on a substitute energy price. This should prevent speculation over a disruption of the balancing energy market. The balancing capacity market thus has the function of an “insurance product” in the event that the balancing energy market is not available.

Promoting competition

Competition is promoted by having two separate markets for balancing capacity and balancing energy. Previously, balancing energy could only be delivered by providers successfully bidding in the capacity market; now balancing energy may be delivered by all pre-qualified providers and – in contrast to the old design of the tendering process – indeed independent of participation in the capacity market.